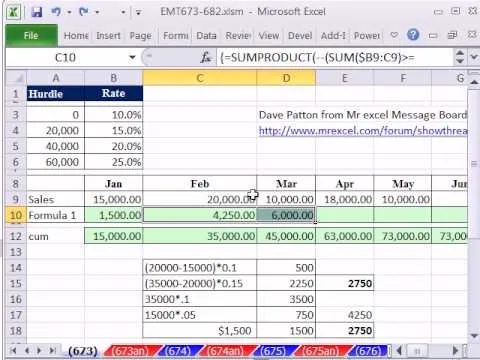

Whether you're interested in learning Microsoft Excel from the bottom up or just looking to pick up a few tips and tricks, you've come to the right place. In this tutorial from everyone's favorite digital spreadsheet guru, ExcelIsFun, the 48th installment in his "Highline Excel Class" series of free video Excel lessons, you'll learn how to use the RATE, EFFECT, NOMINAL and NPER Excel functions to solve the following problems:

1. Calculate adjusted interest rate for loans with points using the RATE function

2. See a math formula to calculate the effective interest rate for a loan given the APR or nominal rate

3. Use the EFFECT function to calculate the effective interest rate for a loan given the APR or nominal rate

4. Solve this finance problem: Savings plan that compounds interest 365 times a year but you put money in 12 times a year. What is future value?

5. How long to pay off your credit card if you pay only the minimum PMT required? See the NPER function.

6. Use the NPER function to calculate how long it takes to pay off your credit card balance when you make only the minimum payment.

Comments

Be the first, drop a comment!