In this three-part video tutorial, learn how to manage loans with an amortization table in Excel. The three parts of this video go over the following:

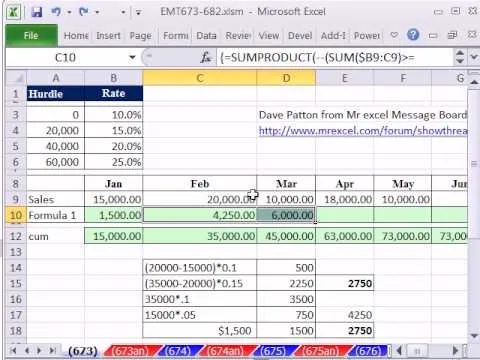

Part 1: Create a mortgage (loan) payment calculator with an amortization table (payment schedule) for detailed payment information.

Part 2: Use IF functions to hide negatives in the amortization table if/when you make extra payments and pay off the loan sooner than planned.

Part 3: Using IF function to zero out remaining rows when the loan is paid off early.

Comments

Be the first, drop a comment!