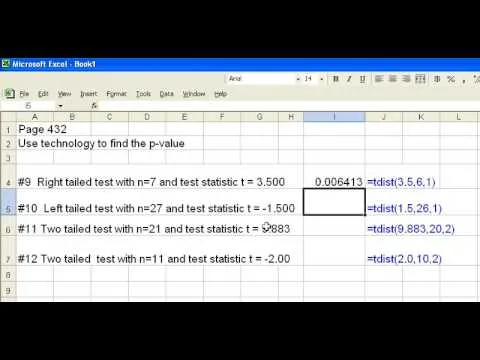

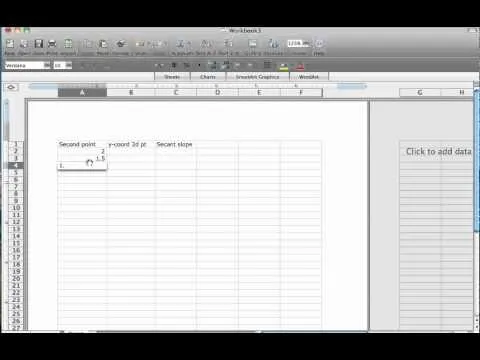

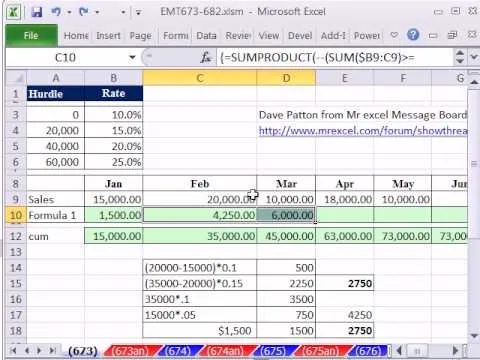

Some savings plan pays interest 365 days in a year but you make deposit monthly. You can use Excel functions to calculate the maturity value of the of the monthly plan. To do this you have to use the nominal and effect functions before using the future value functions. First enter the know data like the monthly payment, the number of years of payment, the number of days in a year, and the annual percentage rate. First take the nominal rate and calculate the effective rate with the help of effect function. Notice that the effective rate is greater than the nominal because of compounding. Now from this you can compute the annual percentage rage rate from which you can calculate the maturity value. This video shows how to compute maturity values with daily interest deposits.

Apple's iOS 26 and iPadOS 26 updates are packed with new features, and you can try them before almost everyone else. First, check Gadget Hacks' list of supported iPhone and iPad models, then follow the step-by-step guide to install the iOS/iPadOS 26 beta — no paid developer account required.

Comments

Be the first, drop a comment!